Hyperliquid’s 24/7 Onchain Markets Prove Price Discovery Never Closes

While Wall Street slept through a Saturday night of airstrikes, onchain traders were already repricing the world in real time.

Anchorage Digital and Tether Release First USAT Stablecoin Reserve Report

Tether’s U.S.-focused stablecoin venture released their first reserve report this week, showing the stablecoin token USAT fully backed.

Nasdaq Seeks SEC Approval to Launch Prediction-Style Index Options

Nasdaq is seeking SEC approval to list fixed-payout Outcome-Related Options tied to the Nasdaq-100 indexes, a move that could expand binary-style

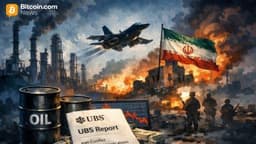

UBS Forecasts Broad Commodities Rally as Investors Hedge Iran-Linked Uncertainty

Escalating U.S.-Iran tensions rattle oil, gold, and equities as UBS projects limited energy disruption and stronger broad commodities gains into 2026, led

Steak 'n Shake Launches 21-Cent-Per-Hour Bitcoin Bonus for Employees

Steak 'n Shake is embedding bitcoin into employee pay, granting hourly workers a crypto bonus and adding $1,000 child savings contributions, advancing an